Introduction

Multiple costs should be accounted for when considering a mortgage. Loan origination fees are common and paid to the lender for the service of originating and sometimes underwriting a loan. It's not hard to keep track of all the many expenses that crop up during the home-buying process. It's very uncommon for the total cost of purchasing a property to end up being higher than originally anticipated for several reasons. The mortgage origination fee is one of the many expenses inherent in the final cost of a property purchase. Below is what you need to know and how to minimize origination fees and expenses.

How to Pay Less on a Home Loan?

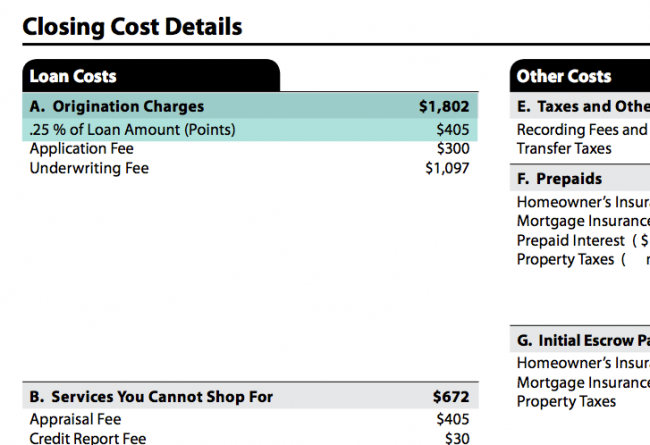

Origination fees can also be known as application fees, underwriting fees, and processing fees. Points are extra payments made to the lender in exchange for a lower interest rate. There are various ways to reduce the amount paid at the loan's inception.

Get Gifts

Inquire with your lender about the possibility of using gift cash to cover the cost of the loan's origination. But there are additional challenges when accepting presents for a home as a down payment. The lender's policies on accepting presents as partial payment for these costs should be checked. A close relative who is also prepared to help you put the donation in writing is one possible source of the necessary funds.

Look Around

For a loan of any size, it's smart to shop around and compare at least three distinct offers. Find the best deal by comparing interest rates and other fees charged by various lenders. The total amount of origination fees is more relevant than the precise names used.

Pay Upfront

Paying costs in full at the outset is the most direct method. This is the most unpleasant method, but it gives you the greatest control over your finances and the possibility of better rates if you can pay in full at the outset. Banks may advertise interest-free loans, but no one works for nothing. Lower down payment will result in a lower interest rate.

Get Lender Credits

This tactic is the polar opposite of the one I just described. If you accept a slightly higher interest rate, your lender may provide money (called lender credits) to help cover your closing expenses. 1 A trustworthy lender would lay out all your possibilities, including those with and without lender credits. Choosing a higher interest rate will result in higher total interest paid. Therefore this tactic is most cost-effective when the loan term is very short.

Review Estimated Costs

Be wary of the list of closing expenses in any loan estimates you receive since this is where hidden fees might be hidden. Typically, only the costs listed above should be incurred. You should contact them for more information if there are any costs on the loan estimate that you are unfamiliar with or do not recall the lender discussing.

Look for Closing Cost Assistance

If you are a first-time buyer, a buyer with a low income, a veteran, or a member of the armed forces, you may qualify for a unique program that will pay some or all of your closing expenses. A few huge banks will even cover certain fees for their loyal customers. NAR reports that only a small number of states establish the minimum and maximum prices. Thus consumers may find themselves with few choices in certain areas. Real estate agents often recommend budgeting around $1,000. However, this can vary widely from state to state and even city to city, depending on the specifics of the policy and the property in question.

Borrow More Money to Pay Less

The potential for negotiation exists if the size of your loan is larger than the typical loan. The median home loan amount is $239,265 as of 2018, per data from the Mortgage Bankers Association. If the lender charges the market rate of 1 percent for the loan's origination, they will make almost $2,400. If you borrow $500,000, the origination charge is the same as 1% of the loan amount, or $5,000. The lender won't have to put in any extra effort to service your larger loan, but he will make more money. Therefore, one option to negotiate this fee is to propose an origination fee of $2,500, or 0.5%, of the larger loan amount. Because of this deal, you pay less, and the lender makes more than he would from a standard origination fee.

Conclusion

The costs incurred by the lender in approving your loan application are known as "loan origination fees." It is possible to spend less on these costs by shopping in comparison, taking advantage of lender credits, or negotiating a lower rate. Larger loans often have lower fees, ranging from 0.5 percent to 2 percent.